The only way we believe this is possible over long periods consistently is to invest in businesses that have the ability to grow cash flows and reinvest this capital within the business. At ITUS, a portfolio is constructed to protect the downside and to compound capital over time. I believe the key factors from our vantage point has never changed, be it in the middle of a bear market or in the middle of a bull market, where we in today. Q: What are the key factors one should consider before picking a stock or create a portfolio of stocks?

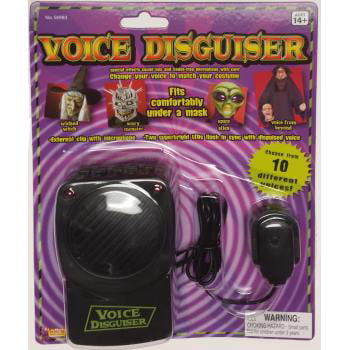

POD FARM VOICE CHANGER UPGRADE

These companies will see a significant earnings upgrade over the next two years. There are going to be specific companies that will have the ability to pass these price increases over time to their end customer (be it B2B or B2C). However, some of the more forward-looking managements will speak about the margin pressure increasing due to the supply chain disruptions across industries (logistics, packaging, raw material cost increase). Companies are going to show robust growth with earnings growing between 16 and 18 percent as we are still coming off a low base. I believe you would notice two trends in this quarter and next. Q: What are your broad expectations for September 2021 quarter earnings? Will these quarterly earnings help analysts revise upwards their FY22 and FY23 forecasts? I rather see RBI following this path today. The RBI needs to focus on credit flow into the private sector and investments increasing on the ground. I would rather they have a longer-than-normal dovish policy rather than working on an exit. I do not believe working on the exit policy today needs to be on the highest order of focus for the RBI. We are at the early stages of recovery which can be followed by years of robust growth. Q: Is the RBI coming closer to an exit policy? Will the policy provide adequate cues on the likely glided path of normalisation? This is where risks increase alongside too. Today, everyone wants to get involved as the new investor does not want to get left out. It’s been a great trade for anyone who bought it in this period. This, coupled with increasing talk of privatisation, has given the companies in this sector significant returns in the last 1.5 years. The Covid-induced shutdowns last year resulted in supply side shocks, which has resulted in the price of commodities going up across the board (metals, energy, oil, soft commodities). This had a circuitous impact on the performance. With regard to PSUs-there were seven years of underperformance due to poor capital allocation, which resulted in low levels of ownership. There have been a sequence of events that have led to this (in the markets, there's never one reason). What are reasons for this rally? Is the under-ownership one of reasons? Q: Several public sector companies including those in oil, power and coal saw a big run up in stock prices. I do not believe that there would be a US debt default that one needs to worry about. Today, this can sustain as long as growth in the real economy picks, up which is currently happening. Today, the Fed (the US Federal Reserve) has taken the stance towards spending through borrowing which has had an unprecedented increase in their balance sheet. Clearly it’s a good sign for the country's stability as the borrowing costs naturally go lower as flows get robust. Another aspect to note is that an outlook change is never an isolated event, meaning, I would put my hand up and say more upgrades are on the cards. Today's environment is no different, and one should not be very surprised by the Moody's outlook improvement. If one looks at the cause for this, it becomes clear that when the markets make new highs, the expectation for growth increases with spending on the ground increasing. It was not surprising to see a 95 percent correlation between Moody’s upgrades and the Nifty being at a new high. We recently conducted an internal analysis within our team between the sequence of Moody's downgrades and upgrades in the country and the correlation with Nifty levels. Does it mean that risks for the financial sector are lower now along with visibility of sustained growth and a gradual fiscal consolidation? Q: Moody’s has changed India's rating outlook to stable from negative. Unlocking opportunities in Metal and Mining.Sustainability 100+ Pharma Industry Conclave.Managing Diabetes with Ayurveda India Inc On The Move.Score Dekha Kya Life Insurance Made Simple.

POD FARM VOICE CHANGER SERIES

0 kommentar(er)

0 kommentar(er)